Startup Valuation

4 MONTHS

Any Graduate, Bcom, BBA, BE, CA, CFA, MBA

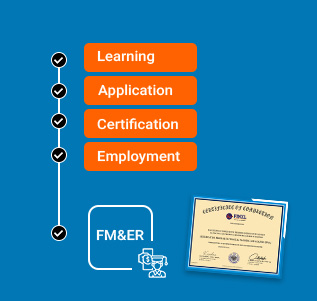

Get a Globally Accepted Certification

Our course is thoughfully designed in such a way that learner gets the Real Time Investment banking & Equity Research exposure. Learner is not necessarily be from finance background, as our course ensures that Basic finance & account concepts are covered in detail with real time examples.

It is 80% practical with industry used case studies.

Our assessment & presentation evaluations are similar to top investment banks & equity research firms Our expert trainers are on hand to help answer any questions you might have along the way.

Course Features

EXPERT SUPPORT

Online support from our team for all your queries based on ticket based tracking system

CERTIFICATION

Get 3 certifcations inone course financial modeling, equity research and advance excel. You can show them seperately in resume.

REAL TIME CASE STUDIES

Live case studies for each financial topics to ensure that learner can understand it thoroughly.

RESUME PREPARATION

Our expert will assist you in resume building and job portal updation.

LIFETIME ACCESS

You get lifetime access to the FINXL LMS which includes videos, excel spreadsheets, presentations, ebooks, quizzes and case studies.

FORUM

Our career square forum is ths most dynamic platform to connect with expert across the globe.

Introduction

Startup valuation involves assessing and assigning a monetary value to a newly established company. This complex task requires a thorough evaluation of essential factors, including market size, competitive landscape, revenue projections, intellectual property, team expertise, and growth potential. Various methodologies, such as discounted cash flows, market comparables, and risk-adjusted approaches, are utilized to estimate the startup's value. Accurate valuation enables investors and stakeholders to make informed decisions regarding investment opportunities, strategic partnerships, and growth prospects. It serves as a crucial tool for gauging the financial health and attractiveness of a startup in the business landscape.

Course Details

Course duration: Intensive 4 MONTHS

COURSE HIGHLIGHTS

The #1 Course to Land a Job in Valuation

Certified Investment Banking Course with 100% Placement assistance

3/6 months internship with a Startup Valuation firm

Gain hands-on, practical experience during training, similar to a real job within the Investment Bank

80% of the Real-time industry used Case study-based learning

Our trainers: Valuation Expert working professionals with 13+ years of experience

A guide to over 100+ frequently asked Valuation questions and their answers

Build 5 financial models from scratch of your chosen Listed/Private companies

Be part of our Global Valuation Analyst alumni network

IPOs, Bonds, M&A, Trading, LBOS, Pitch deck, Valuation: Everything is included!

Prepare a company’s Budget from Scratch

Dedicated Placement Manager with 1-on-1 mentorship

MODULE 1: MS EXCEL EXPERT

Excel Essentials & keyboard shortcuts

Basic & advance excel functions

DATEDIF, YEAR, YEARFRACE & MONTH

Index, Search, Choose, offset

Using SUMIF, COUNTIF, AND AVERAGEIF

Sensitivity analysis with Data tables

Using VLOOKUP/HLOOKUP/ Match Index

Pivot table, Charting commonly used

Conditional Formatting, Paste Special

Dashboards, Templates, Macros

MODULE 2: DATA COLLECTION AND MODELING

Sources for authentic financial data for US, India, China, Germany, and Singapore companies

Tricks to collect data in the shortest time

Data collection & Data structuring for model

Understanding of Financial Reports & their types

Types of filing 10-K, 10-Q, 8-K, 20-F etc

Create a Model template for 5 years of historical data for

Revenue Drivers

Cost Drivers

Income statement

Balance sheet

Cash flow statement

Dividend schedule

Asset Schedule

Debt Schedule

Equity Schedule

MODULE 3: FINANCE FUNDAMENTALS

What Research Analyst does?

Skill set requires for Equity Research Analyst?

Job roles of BUY SIDE and SELL SIDE Analysts

Understanding, Reading & Analyzing of

Income statements & Balance sheet

Cash flow statements

Notes to accounts

GAAP & Non-GAAP/Reported & Adjusted numbers

Reported/Adjusted /GAAP/Non-GAAP EPS

Restructuring & Adjusted numbers

Pro-forma Income statement

Restating financials for valuation and analysis

Concepts & treatment of the following points

Minority/Non-controlling

Associates

Subsidiary

Convertible debt/securities

5 case studies on live small business

Make a business plan for startups

Corporate actions & their treatments

Rights issue

Bonus issue

Takeover

Merger

Acquisitions

Interim/Annual dividend

Stock splits

Spin-off

Reverse split

MODULE 4: SECTOR/INDUSTRY RESEARCH

(Analyzing Sectors/Industries/Companies)

Company's Business model understanding

Economies/Sectors/Industries understanding

Operational drivers & cost drivers & Projection

Factors that impact the company's projections & valuations

Case studies on 'Top Down' and 'Bottom Up' approaches

Forecasting of IS, BS, CFS, and Schedules

MODULE 5: FINANCIAL MODELING & VALUATION

Interlinking of financial statements (IS, BS, CFS)

Tallying the balance sheet in 30 minutes

Use best practices in Financial Model Building

Understand & develop a forecasting basis for each line of IS, BS & CFS

Build & Forecast Advanced Schedules including the following points

Debt Repayment Schedule (DRS)

Fixed Assets Module (FAM)

Dividend & Equity Schedule (ES)

RATIOS:

In dept conceptual understanding of financial ratios we include the following points

Liquidity ratios

Leverage ratios

Efficiency ratios

Profitability ratios

Market value ratio

Calculation and analysis of ratios on your chosen company

Compare your company's ratios with competitors

DuPont analysis

MODULE 6: INTRODUCTION TO VALUATION

Overview of valuation: Introduce students to the concept of valuation and its importance in decision making. Provide an overview of the different types of valuation and their uses.

The role of valuation in decision making: Explore the role of valuation in decision making, including investment decisions, mergers and acquisitions, and financial reporting.

Key valuation approaches: Introduce the three main valuation approaches: income, market, and asset based

Understanding financial statements and ratios: Review the key financial statements and ratios used in valuation, including the income statement, balance sheet, and cash flow statement.

Time value of money: Explain the time value of money and its importance in valuation, including present value and future value calculations.

MODULE 7: DISCOUNTED CASH FLOW ANALYSIS

Understanding the basics of DCF: Introduce the basics of DCF analysis, including the calculation of free cash flows and the use of a discount rate.

Steps involved in conducting a DCF analysis: Outline the steps involved in conducting a DCF analysis, including forecasting future cash flows, determining the appropriate discount rate, and calculating the terminal value.

Forecasting future cash flows: Discuss the methods used to forecast future cash flows, including historical data, analyst forecasts, and management projections.

Determining the appropriate discount rate and terminal value: Review the methods used to determine the appropriate discount rate and terminal value in a DCF analysis.

Sensitivity analysis: Explain the importance of sensitivity analysis in a DCF analysis and how it can be used to assess the impact of changes in key assumptions on the valuation.

MODULE 8: COMPARABLE COMPANY ANALYSIS

Understanding the basics of CCA: Introduce the basics of CCA, including the selection of comparable companies and the use of valuation multiples.

Identifying and selecting comparable companies: Discuss the methods used to identify and select comparable companies, including industry and size comparability.

Adjusting for differences between comparable companies and the target company: Review the methods used to adjust for differences between comparable companies and the target company, including adjustments for size, growth, and profitability.

Analysing the results of the CCA: Explain how to analyse the results of a CCA and how to interpret the valuation multiples.

MODULE 9: PRECEDENT TRANSACTION ANALYSIS

Understanding the basics of PTA: Introduce the basics of PTA, including the selection of precedent transactions and the use of transaction multiples.

Identifying and selecting precedent transactions: Discuss the methods used to identify and select precedent transactions, including transaction size and timing comparability.

Adjusting for differences between precedent transactions and the target company: Review the methods used to adjust for differences between precedent transactions and the target company, including adjustments for size, growth, and profitability.

Analysing the results of the PTA: Explain how to analyse the results of a PTA and how to interpret the transaction multiples.

MODULE 10: ASSET BASED VALUATION

Understanding the basics of asset-based valuation: Introduce the basics of asset-based valuation, including the identification and valuation of the company's assets and liabilities.

Identifying and valuing the company's assets and liabilities: Discuss the methods used to identify and value the company's assets and liabilities, including tangible and intangible assets.

Adjusting the asset-based valuation for market and economic conditions: Review the methods used to adjust the asset-based valuation for market and economic conditions.

MODULE 11: VALUATION ADJUSTMENTS

Normalization adjustments: Review the methods used to make normalization adjustments to financial statements, such as adjusting for non-recurring items, extraordinary items

Non-operating assets and liabilities: Discuss the treatment of non-operating assets and liabilities in valuation and the impact they can have on the valuation.

Control premiums and minority discounts: Introduce the concept of control premiums and minority discounts and how they affect valuation.

Synergies: Discuss the importance of synergies in valuation and the methods used to estimate them.

Other valuation adjustments: Review other common valuation adjustments, such as adjustments for marketability and liquidity.

MODULE 12: VALUATION APPLICATIONS

Equity valuation: Discuss the application of valuation techniques to equity valuation, including the use of multiples and the dividend discount model.

Business valuation: Explore the application of valuation techniques to business valuation, including the determination of enterprise value and the use of weighted average cost of capital (WACC).

Mergers and acquisitions: Discuss the use of valuation techniques in mergers and acquisitions, including the determination of a fair price for the target company.

Valuation for financial reporting: Review the use of valuation techniques for financial reporting purposes, such as the impairment testing of goodwill and other long-lived assets.

MODULE 13: VALUATION CHALLENGES AND ETHICS

Valuation challenges: Discuss the common challenges faced in valuation, such as the lack of reliable information, the uncertainty of future events, and the complexity of valuation models.

Ethical considerations in valuation: Explore the ethical considerations in valuation, such as conflicts of interest, insider trading, and the appropriate use of valuation techniques.

Case studies: Present case studies that demonstrate the challenges and ethical considerations in valuation and discuss how they were resolved.

MODULE 14: PRESENTATION, REAL CASE STUDIES, MOCK INTERVIEWS, SOFT SKILL

10+ real-time case studies

Prepare you on 100+ frequently asked Equity Research Interview questions with answers

Positive attitude and emotional intelligence training

Placement managers for 1 on 1 mentorship

Communication and interpersonal skills training

Conduct regular mock interviews

Work on individual strengths, and weaknesses and prepare an interview script

Profile building and marketing

Interview scheduling & helping candidates in placements

Pre-Requisites

Does basic knowledge of Finance / Accounting needed? Not required as we start from basics

Does basic knowledge of Excel needed? Not required as we start from basics

Does any Finance degree or Finance background required? Previous finance knowledge will help but not compulsory

Target Audience

Any commerce Graduates & Post Graduates (BBA, BCOM, BBM, MCOM), Non-Commerce Graduate or Post Graduate (BSC, Engineers, B.E., B. Tech, M.E., After MBA OR During MBA, CFA or any degree in Finance, MBA/CFA/CA Aspirants, CPAs, ICWA, CS, Back office/operations working professionals, accounting working professionals, KPOs/BPOs professionals, Financial Analysts, Business Analysts, Startup founders, Bankers, Financial Controllers, CFOs, CEOs, Fund Managers, PE Fund Managers, Account Receivables (AR), Accounts Payables (AP), Record To Report (R2R), Reconciliation background professionals, housewives after a long gap of marriage or kids to make a career in the Finance field, Businessman / Entrepreneur.

Sales and Marketing skilled Individuals seeking a career change to the core finance domain

Research Companies

| > UBS | > Deloitte | > Deutsche Bank |

| > FIS | > BNP Paribas | > Honeywell |

| > Nomura | > J.P. Morgan | > Grand Thornton |

| > Syngenta | > TCS | > Transparent Value |

| > HSBC | > Bajaj Finserv | > Capgemini |

| > WNS Global | > Pitte | > Johnson Controls |

| > Elanco | > Spectra | > PKF Advisory |

| > Shore Infotech | > DSIJ | > Eversana |

| > Crisil | > Maersk | > BMC Software |

| > Reval Analytics | > Accenture | > Moody's Analytics |

| > Qualys | > Danfoss | > Veritas |

| > Daloopa | > EY | > Morningstar |

| > Citco | > KPMG | > Barclays |

| > TIAA | > Citicorp | > Tristone |

| > State Street | > Rocket Software | > Cognizant |

| > ZS Associates | > Mitcon Consultancy | > SG Analytics |

| > Credit Suisse | > Infosys | > Thomson Reuters |

| > Vodafone | > Force Motors | > Alcor Fund |

| > Wheaton Advisors | > Cians Analytics | > Dalal Street |

| > Morgan Stanley | > Aspera Advisors | > Genpact |