Investment Banking and Financial Analyst

4.5 months

CA, MBA, B.E., CFA, BCA, BBA, Mcom, BCom

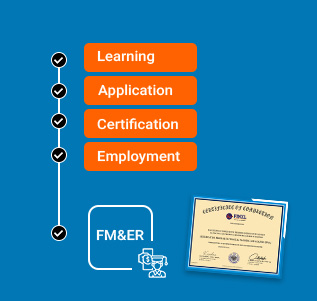

Get a Globally Accepted Certification

Our course is thoughfully designed in such a way that learner gets the Real Time Investment banking & Equity Research exposure. Learner is not necessarily be from finance background, as our course ensures that Basic finance & account concepts are covered in detail with real time examples.

It is 80% practical with industry used case studies.

Our assessment & presentation evaluations are similar to top investment banks & equity research firms Our expert trainers are on hand to help answer any questions you might have along the way.

Course Features

EXPERT SUPPORT

Online support from our team for all your queries based on ticket based tracking system

CERTIFICATION

Get 3 certifcations inone course financial modeling, equity research and advance excel. You can show them seperately in resume.

REAL TIME CASE STUDIES

Live case studies for each financial topics to ensure that learner can understand it thoroughly.

RESUME PREPARATION

Our expert will assist you in resume building and job portal updation.

LIFETIME ACCESS

You get lifetime access to the FINXL LMS which includes videos, excel spreadsheets, presentations, ebooks, quizzes and case studies.

FORUM

Our career square forum is ths most dynamic platform to connect with expert across the globe.

Introduction

Investment banking is a specialized area of finance that plays a critical role in the global economy. It involves providing advisory and financial services to corporations, governments, and other organizations to help them raise capital, make strategic decisions, and execute complex transactions.

Course Details

Course duration: Intensive 4.5 months

COURSE HIGHLIGHTS:

The #1 Course to Land

a Job in Investment banking.

Certified

Investment Banking Course with 100% Placement assistance.

3/6 months internship with

an Investment banking firm.

Gain hands-on, practical

experience during training, similar to a

real job within the Investment Bank.

80%

of the Real-time industry used Case

study-based learning.

Our trainer: Investment Banking working

professional.

A guide to over 100+ frequently asked Investment Banking questions and their

answers.

Build 5 financial models from scratch of your chosen Listed/Private

companies.

Be part of our Global Investment

Banking alumni network.

IPOs, Bonds, M&A,

Trading, LBOS, Pitch deck, Valuation: Everything is

included!

Prepare a company’s Budget

from Scratch.

Dedicated Placement Manager

with 1-on-1 mentorship.

MODULE 1: MS EXCEL EXPERT

Excel Essentials & key board accelerators

Basic & advance excel functions

Conditional Formatting, Paste Special

Using VLOOKUP/HLOOKUP/ Match Index

Using SUMIF, COUNTIF, AND AVERAGEIF

DATEDIF, YEAR, YEARFRACE & MONTH

Index, Search, Choose, offset

Sensitivity analysis with Data tables

Pivot table, Charting commonly used

Dashboards, templates, Macros

MODULE 2: DATA COLLECTION AND MODELING

Sources for authentic financial data for US,

India, China, Germany, and Singapore companies

Tricks to collect data in the shortest time

Data collection & Data structuring for model

Understanding of Financial Reports & its

types

Types of filing 10-K, 10-Q, 8-K, 20-F

etc.

Create Model template for 5 years historical

data for`

Revenue

Drivers

Cost Drivers

Income statement

Balance sheet

Cash flow statement

Dividend schedule

Asset Schedule

Debt Schedule

Equity

Schedule

What Investment Banker does?

Skill set requires for an Investment Banker?

Job roles of BUY SIDE and SELL SIDE Analysts

Understanding, Reading & Analyzing of

Income statements

& Balance sheet

Cash

flow statements

Notes

to accounts

GAAP

& Non-GAAP/Reported & Adjusted numbers

Reported/Adjusted

/GAAP/Non-GAAP EPS

Restructuring

& Adjusted numbers

Pro-forma Income statement

Restating

financials for valuation and analysis

Concepts & treatment of the following points

Minority/Non-controlling

Associates

Subsidiary

Convertible

debt/securities

5 case studies on live small business

Make a business plan for startups

Corporate actions & their treatments

Rights issue

Bonus

issue

Takeover

Merger

Acquisitions

Interim/Annual

dividend

Stock

splits

Spin-offs

Reverse split

MODULE 4: FINANCIAL MODELING & VALUATIONS

Interlinking of financial statements (IS,

BS, CFS)

Tallying the balance sheet in 30

minutes

Use best practices in Financial

Model building

Understand & develop forecasting

basis for each line of IS, BS & CFS

Build & Forecast Advanced

Schedules including the following points

Debt Repayment Schedule (DRS)

Fixed Assets Module (FAM)

Dividend

& Equity Schedule (ES)

RATIOS:

In depth conceptual

understanding of financial ratios we include the following points

Liquidity ratios

Leverage ratios

Efficiency ratios

Profitability ratios

Market value ratio

Calculation and analysis of

ratios on your chosen company

Compare your company's ratios

with competitors

DUPONT analysis

VALUATION:

(Understanding of various Valuation methods)

1. DISCOUTNED CASH FLOW (DCF):

In depth step by step

understanding of DCF

Product/business/economic

life cycle concepts

Time value of money concepts

Understanding &

calculation of FCFF & FCFE

Cost of Equity using Capital Asset Pricing Model

Cost of Debt (kd)

Cost of preference shares (ke)

Risk Free rate of return (Rf)

for listed & non listed SMEs

In-depth analysis of

systematic & unsystematic Risk

Beta levered & Un-levered Beta

Calculate Beta(β) using last 5 years price

Cost of capital (WACC)

Market Premium (Rm)

Net present value /company

value

Sensitivity analysis

Application of DCF on

your chosen company

’Buy' or a 'Sell' rating

based on analysis

2. RELATIVE VALUATION (RV) (Trading Comps/Exit Multiple)

Step by step understanding of

RV & Trading comps

Criteria to choose

competitors

Criteria to choose Ratios for

comparison

Usage of price multiples P/E,

P/S, EV/EBITDA, P/B

Drive prices using above ratios

Price band and valuation

conclusion

3. SUM OF THE PARTS ANALYSIS (SOTP)

Determine the Business

Segments

Value Each Segment

Pick any of below valuation

method to value the segment

DCF /Comparable companies /

Precedent Transactions

Add up all segment's

valuations

MODULE 5: M&A, LBO MODEL

Leveraged Buyouts

Key Participants

Characteristics of a strong LBO candidate

Economics of LBOs

Primary Exit/Monetization Strategies

LBO Financing: Structures

LBO Financial: Primary Sources

LBO Financing: Selected Key Terms

LBO Financing: Determining Financing

Structures

LBO ANALYSIS

Locating &

Analyzing the Necessary Information

Building the

pre-LBO model

Performing LBO

Analysis

Input Transaction

Structure

Completing the

post LBO model

Grievance

Redressal

Engagement with Credit

ratings Agencies

MERGER & ACQUISITIONS

Sell Side

Auctions

Negotiated Sales

BUY SIDE

Buyer Motivation

Deal Structure

Buy-side valuation

Merger consequences Analysis

IPO

Procedures to change to a public

structure

Factors Triggering the Timing of Going

public

The initial public offering IPO team

Initial public offering IPO Costing

The Investor

Prospective

Due Diligence Process

PITCH BOOK

Overview Of Initial Public

Offering (IPO)Process

Definitions of initial

Public Offering

Why companies go Public?

The parties Involved

Your Company

External Auditors

Investor/Public relations

Lawyers

Investment Banks

Criteria's to be needed before

applying for an initial public offering IPO

Advantages and disadvantages of going

public

STEPS FOR INITIAL PUBLIC OFFERING (IPO)

Investment Banking Pitch Book

How build a pitch book

Sell Side pitch book for sell side

mandates

Buy side pitch book examples

Equity Pitch Book and Debt Pitch Book

Examples for financing Mandates

What do you need to know about pitch

books as an intern or new hire

REGULATORS & MARKET REQUIREMENT

Regulatory Compliance

Core Requirement

Financial Positions Profit Record

Stability of Business Minimum Expected

Market capital

Public Float

MARKET AND INVESTOR REQUIRNMENTS

Accounting Methods

Valuation of the company

Governance /

Responsibilities of the board

INITIAL PUBLIC OFFERING IPO PROCESS

Investment Bank Selection

Registration the Initial Public Offering

Regulation Fillings

The Underwriting Structure

Pricing & Underwriting

Methods of Flotation

MODULE 10: POWER BI

Power BI is a business analytics service provider by Microsoft. It provides interactive visualizations with self-service business intelligence capabilities, where end users can create reports and dashboards by themselves without having to depend on any information technology staff or data base administrator. Power BI certification course shares knowledge on how it provides cloud based BI services-known as Power BI Services, along with a desktop-based interface called Power BI Desktop. It offers data modeling capabilities including data preparations, data discovery, and inter active dashboards.

TOPICS COVERED:

Introduction to Power BI

Basic components of Power BI

Loading Data in Power BI Desktop

Data Cleaning using Power BI query editor

Transform, Clean, Shape and Model Data for further analysis.

Creating Calculated Columns and measures

Performing data analysis using DAX

Visualization Charts in Power BI

Slicers and Map Visualizations

Creating cards, measures, KPI, reference line, and slicers

Creating reports and dashboards

Publishing reports on Power BI Services

Using Power BI service for operations on reports

MODULE 11: PRESENTATION, REAL CASE STUDIES MOCK INTERVIEWS, SOFT SKILL

10 real time case studies

Prepare you on 100+ frequently asked FP&A Analyst interview questions with answers

Positive attitude and emotional intelligence training

Placement managers for 1 on 1 mentorship

Communication and interpersonal skills training

Conduct regular mock interviews

Work on individual strengths, and weaknesses and prepare an interview script

Profile building and marketing

Interview scheduling& helping candidates in placements

Pre-Requisites

Does basic knowledge of Finance / Accounting needed? Not required as we start from basics

Does basic knowledge of Excel needed? Not required as we start from basics

Does any Finance degree or Finance background required? Previous finance knowledge will help but not compulsory

Target Audience

Any commerce Graduates & Post Graduates (BBA, BCOM, BBM, MCOM), Non-Commerce Graduate or Post Graduate (BSC, Engineers, B.E., B. Tech, M.E., After MBA OR During MBA, CFA or any degree in Finance, MBA/CFA/CA Aspirants, CPAs, ICWA, CS, Back office/operations working professionals, accounting working professionals, KPOs/BPOs professionals, Financial Analysts, Business Analysts, Startup founders, Bankers, Financial Controllers, CFOs, CEOs, Fund Managers, PE Fund Managers, Account Receivables (AR), Accounts Payables (AP), Record To Report (R2R), Reconciliation background professionals, housewives after a long gap of marriage or kids to make a career in the Finance field, Businessman / Entrepreneur.

Sales and Marketing skilled Individuals seeking a career change to the core finance domain

Research Companies

| > UBS | > Deloitte | > Deutsche Bank |

| > FIS | > BNP Paribas | > Honeywell |

| > Nomura | > J.P. Morgan | > Grand Thornton |

| > Syngenta | > TCS | > Transparent Value |

| > HSBC | > Bajaj Finserv | > Capgemini |

| > WNS Global | > Pitte | > Johnson Controls |

| > Elanco | > Spectra | > PKF Advisory |

| > Shore Infotech | > DSIJ | > Eversana |

| > Crisil | > Maersk | > BMC Software |

| > Reval Analytics | > Accenture | > Moody's Analytics |

| > Qualys | > Danfoss | > Veritas |

| > Daloopa | > EY | > Morningstar |

| > Citco | > KPMG | > Barclays |

| > TIAA | > Citicorp | > Tristone |

| > State Street | > Rocket Software | > Cognizant |

| > ZS Associates | > Mitcon Consultancy | > SG Analytics |

| > Credit Suisse | > Infosys | > Thomson Reuters |

| > Vodafone | > Force Motors | > Alcor Fund |

| > Wheaton Advisors | > Cians Analytics | > Dalal Street |

| > Morgan Stanley | > Aspera Advisors | > Genpact |